Embattled Eurozone

Simmering With Greece

“Pass this Bill,” urged President Barack Obama, warning that the alternative to his jobs plan was a crisis that would resemble Europe’s. In Sarah Palin’s letter to her Political Action Committee, she stressed the need for a leader to show the US the way, lest it follows the ‘road to European socialization.” Unsurprisingly, Europe has loomed over American politics for the better part of two years, and unfortunately, it is viewed more as a cautionary tale than a crisis. The world would do well to sit up and try to find a solution.

What Obama’s rallying cries and Palin’s simplistic rhetoric fail to elucidate are the reasons behind Europe’s woes. This crisis had its roots in booming economic growth in the 1990’s and early 2000’s and came to fruition with a combination of debt and slowed growth. Ultimately, however, what drew people to protesting and rioting was dire unemployment.

A Chronic Problem

While Obama’s speech was as much a political scare tactic as it was economic wisdom, Palin’s claim is more interesting. The road to “European Socialization” is one that has acquired a meaning beyond its scope in recent years. Unfortunately, however, it does have a grain of truth to it.

In the last thirty years, European policy has tended to favor more government spending rather than less. Whether or not this is perceived as a good idea depends more on one’s political leaning than any economic argument: the latter can be made convincing either way. The consequence of this has been low levels of private investment, which in turn has lead to lower levels of productivity and therefore lower wages. In short, the Eurozone as a whole has not seen the kind of growth exhibited by the US in the last thirty years; to call it a lost generation would be putting it mildly.

When booming growth did come, it was spurious. The economies of Ireland, Greece and Portugal all surged in the early 2000’s, but this growth was driven by unsustainable borrowing. Debt-to-GDP ratios ballooned, and the euro as a whole was weakened. When the the global banking system collapsed in 2008 the boom suddenly turned into a catastrophic bust. Credit ratings were downgraded, Greece defaulted on its debt and crippling austerity measures were implemented.

Sadly, the austerity, like the profligacy that preceded it, the austerity has been extremely short sighted. In a complete about-face, the same countries that allowed themselves to spend recklessly are now bafflingly cautious. Failing to achieve a middle ground between long-term debt-management and short-term growth, Europe swiftly plunged into riot-inducing unemployment.

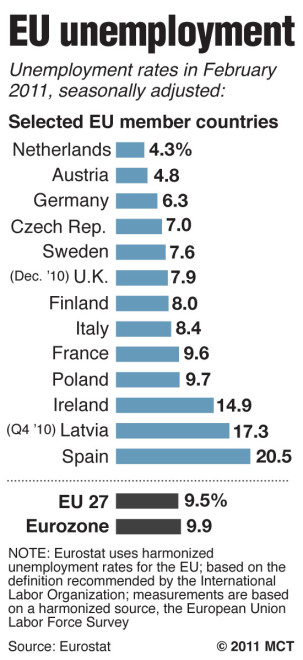

The numbers make painful reading. Greece and Spain are hovering around 16% and 21% unemployment, while Portugal is up to 12%. Worryingly, this is despite GDP growth being back to pre-2008 levels. It speaks of unsustainable, unequally distributed economic growth.

Some Painful Choices, Some Easy Ones

In today’s rhetoric, what can be attributed to incompetence is attributed to something more sinister. At its core, the crisis in Europe is a case of economic mismanagement. Government spending, while dangerous as a cure-all, cannot be abandoned altogether. As was argued on these pages in a previous edition, Germany needs to come to the rescue of its neighbors to prevent a catastrophic weakening of the euro. The last thing Europe needs is borrowing-driven inflation, which would only add to its list of woes.

While planning for a long-term revival, Europe should put into place the mix of spending and austerity that would propel its growth. The last thirty years have culminated in a nightmarish mix of unemployment and inequality, and the warning signs of more to come are everywhere. Obama’s words ring just as true across the Atlantic.