A Tax on Success

As this is my first article for WUPR, an introduction is in order. My name is Michael Feinstein, and I am a junior in the School of Engineering at Washington University, majoring in computer science and healthcare management. I will give you, my reader, a warning now: if you are looking for politically correct drivel, read something else. I am not here to paint pretty pictures of unicorns and talk about how perfect the world could be. I am here to paint a different picture of the world than most of you are probably used to — what the world is actually like. I will speak my mind regardless of whether you agree with me or not (feel free to send me an angry email!). Many of you will loathe me for it. How unfortunate for all of us.

What better topic to address first than one closely guarded by most students here at Wash U: the concept of success. Success can mean many different things to many different people. As a student, you probably think of top grades, a stunning list of extracurricular activities, and leadership positions as your present list of goals to strive toward. Many of you, who are all obviously at least 21 years of age, would also add your record number of shots in one sitting to this list as a further statement of your pride and character.

For the purposes of this topic, I will restrict the criteria to grades and leadership positions. Stop and think of a time when you aced a really important exam. What words would you use to describe your success? Achievement? Payoff? You feel as though you deserve what you’ve earned, right? (Unless you cheated… then shame on you.) Of course you do. That feeling of success helps you move on and accomplish similar tasks in the future. What about when you fail an important exam? It happens to all of us at one point or another. Lack of sleep, lack of studying, and a general lack of give-a-crapness are all possible contributing factors to such an event. What was your visceral response to that grade? You never, ever want to put yourself through that again. You study more until you feel confident that you can earn a higher grade.

At this point, you’re probably exclaiming to yourself, “I thought this was WUPR, not Academic Weekly!” Bear with me, fellow students. What about that leadership role you have worked so hard to achieve? You feel empowered because your actions have earned you a respected position in the Wash U society. When you graduate, you will have to pass on your position to someone else who, you hope, is just as deserving of the job as you were.

Would you walk up to a group of people on the way to class and offer them the responsibilities of that position? Would you feel good about your hard work knowing that these random students now possess all of the power you had when they didn’t contribute anything? Of course not! You know that they have to start from the bottom rung of the ladder, just like you did.

Would you be willing, out of the goodness of your heart, to cut your perfect GPA by 0.5 points in order to give someone who is struggling with classes at Fontbonne University a GPA boost? (Has anyone ever seen students on their campus?) Sure, you might not have a 4.0 anymore, but hey, that guy over there now has a shot at going to grad school! You saved his butt! Doesn’t that make you feel all warm and fuzzy inside?

Didn’t think so. The video below summarizes one person’s take on this idea.

http://www.youtube.com/watch?v=lOyaJ2UI7Ss&feature=player_embedded

It is here, fellow students, that I will attempt to dismantle a fundamental Liberal view: the most wealthy citizens should be paying the most taxes to help the less fortunate, or as some call it, spreading the wealth around. Do you see the problem with this yet? Those awful bankers, doctors, and lawyers are earning so much money that they should have to share, you say. They are earning the money. Earning. They didn’t get money handed to them—they worked for it. You are earning your beloved grade point average. You didn’t get it for nothing. But wait, you say, it’s different! Poor people never had a chance to work for that kind of money; we always have the chance to improve our grades!

Not so fast.

How many people did you screw over by getting admitted to Washington University in St. Louis? For the sake of argument, let us assume that Wash U’s admissions rate is approximately 20% and that there are approximately 1,500 undergraduates per class. Because you were admitted here, dear reader, four other WUSTL hopefuls were disappointed. You denied four wonderful students the chance to attend, and further succeed, at this institution. Others were directly penalized by your success! You’ll notice I did not account for yield; students who were accepted but chose another path still had the opportunity to attend this school and succeed here.

Let’s return to our test example. What if you cheated? Did you earn that curved A? No, that dude with the Ninja Turtles shirt to your left did! You have just redistributed success to those who did not earn it. Because of your higher grade, Ninja Turtles guy doesn’t get as big of a grade boost since the class is curved; his A+ is now an A. How do you think Ninja Turtles guy feels about that? He’s probably pissed off, granted,only at this school would a student be mad about a grade change like that.

Ninja Turtles guy now has a choice to make. Does he study even harder, or should he not even bother since his grade will drop anyway? If he studies harder, he will likely get a higher grade. However, that creates an opportunity for you to also get a higher grade. If he knows you’re cheating off of him anyway, is he likely to work against the curve? Nope. His other option is to study less and get a lower grade so that you don’t benefit as much, and, as such, the curve is lowered further. You have lowered Ninja Turtles guy’s motivation to work.

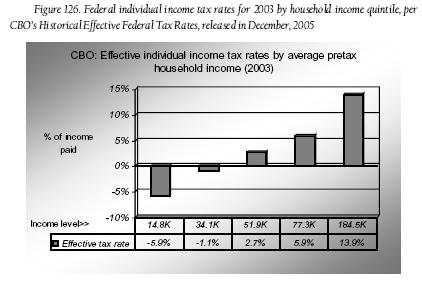

This is what higher taxes do to the top breadwinners of the country. The current maximum income tax rate is 35%. That’s over a third of your income. Regardless of how much you make, that is a huge amount of money. To put it bluntly, a third of your success is being given to other people who didn’t earn it. Good thing we don’t have a 35% GPA tax, eh? None of youwould get into medical school! If you had a 4.0 before, well, since you’re in the top GPA bracket, you now have a 2.6, but you helped 25 hapless students graduate from Fontbonne! Now if you’re pre-med, I’d wager you don’t give a damn. You want your 4.0 back! If you knew this beforehand, would you still try for the 4.0? You could get a 3.46 and be in a lower, 25% bracket, and you would end up with the exact same GPA. The motivation to strive for perfection has vanished.

If you’ve ever held a job and received taxable income, you know how much it sucks to see a huge chunk of it gone before you even get the check. The more you lose out of that check, the less likely you will be willing to work for what you do get. Many, not all, students at Wash U have never worked a day in their lives and are more than willing to volunteer other people’s hard-earned money for the so-called greater good. When you turn 35 and have a couple of jobs under your belt, let me know about how you feel about high taxes then.

If you’ve ever held a job and received taxable income, you know how much it sucks to see a huge chunk of it gone before you even get the check. The more you lose out of that check, the less likely you will be willing to work for what you do get. Many, not all, students at Wash U have never worked a day in their lives and are more than willing to volunteer other people’s hard-earned money for the so-called greater good. When you turn 35 and have a couple of jobs under your belt, let me know about how you feel about high taxes then.

Until next time.